Posts by Cougar Digital

Can You Claim Your Parent as a Dependent?

If you pay over half the cost of supporting a parent, your parent is considered your dependent for federal income tax purposes. This treatment potentially entitles you to some significant tax breaks. Here are four potential benefits to consider when you file your 2023 federal income tax return. How Many Taxpayers Are Affected?According to the Pew…

Read MoreWhat Happens When the Department of Labor Audits an ERISA Plan?

Question: Our organization sponsors both health and retirement plans that must comply with the Employee Retirement Income Security Act (ERISA). We recently received a request from the U.S. Department of Labor (DOL) for plan-related documents. Is this an audit? And if so, what should we expect? Answer: A request for plan documents usually signals the beginning of…

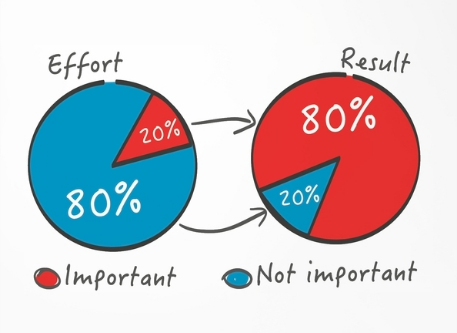

Read MoreDistinguish Your Company’s Elite: Follow the Pareto Principle

Even in America, not all customers are created equal. If you apply the “Pareto Principle” to your sales department, you’re likely to make two discoveries: 80% of your Without a strategy for concentrating on your trophy clientele and putting the rest on the back burner, you could be spinning your wheels to meet the demands of…

Read MoreHow Intended Uses May Affect an Expert’s Value Conclusion

What is the value of my business? That’s the question every business owner wonders from time to time. But the correct answer varies depending on the purpose of the appraisal. Different rules and “standards of value” may apply depending on how the report will be used. Fair Market ValueIn the United States, the most widely recognized and…

Read MoreFamily and Medical Leave: Does Your Program Qualify for the Tax Credit?

In a tight labor market, paid family and medical leave is rapidly becoming more of an expected benefit than just a perk. The good news is the Section 45S federal tax credit for family medical leave programs can help your organization recruit and retain skilled workers while also cutting your tax bill. Here’s what you need…

Read More6 Tax Angles to Layoffs

After a robust job market over the last few years, layoffs are now on the rise. Through November 2023, employers have announced nearly 690,000 job cuts this year, an increase of 115% over the same period last year, according to outplacement firm Challenger, Gray & Christmas. This is the highest January-through-November total since 2020. Prior to…

Read MoreTake Aim at Targeted Worker Tax Credits

If your business is picking up steam, you may be looking to expand your workforce to meet the demand. Here’s a practical idea: Hire employees who qualify for the Work Opportunity Tax Credit (WOTC). The credit is available for workers who represent one of the “target” groups specified by law. There’s no limit on the number…

Read MoreThe ABCs of Business Valuation

The ABCs of Business Valuation You may understand some of the theory behind business valuation, but you probably don’t know the procedures involved in the analysis and preparation of a report. Clients and attorneys who understand how the valuation process works can anticipate their experts’ needs and appreciate why valuators need to ask so many questions…

Read More5 Ways Financial Advisors Can Help Start-Ups Succeed

Every business starts with a “seed” idea that germinates into a fledging business under the right conditions. The decisions that owners make when launching a start-up will impact its financial well-being for years to come. Here are five ways financial advisors can provide critical guidance at this phase of development: 1. Business Planning You’ll need money…

Read MoreEstate Tax Planning Tips for Single People

Estate planning is an important part of your overall wealth management strategy, especially if you’re unmarried. Single parents may worry about who will care for their minor children and whether their surviving kids’ financial needs will be met until adulthood. Likewise, wealthy single people have less flexibility when it comes to shielding transfers from gift and…

Read More